Climate Change Agreements (CCA)

Climate Change Agreements (CCA)

At Here’s The Plan, we provide expert support to help businesses navigate the complexities of the Climate Change Agreements (CCA) Scheme. From managing the application process to ongoing reporting and staying informed on scheme updates, our team ensures you remain compliant every step of the way.

What exactly is a CCA?

How are you eligible for a CCA?

To qualify for a CCA, your site(s) must either:

- Undertake processes under the Environmental Permitting Regulations for your specific industry sector or:

- Your activity meets the criteria under Energy Intensity, tested at specific sector level.

For example, the Food industry’s Trade Association is the FDF, and their eligibility criteria is as follows:

Eligible process = treatment & processing of materials intended for food products

Directly associated activities (DAA) = On-site activities essential to support the eligible process e.g. boilers, compressors, refrigeration

Ineligible activities = e.g. offices, staff areas (changing facilities, canteen, WCs

No matter the industry you are in, you must understand the 70:30 rule.

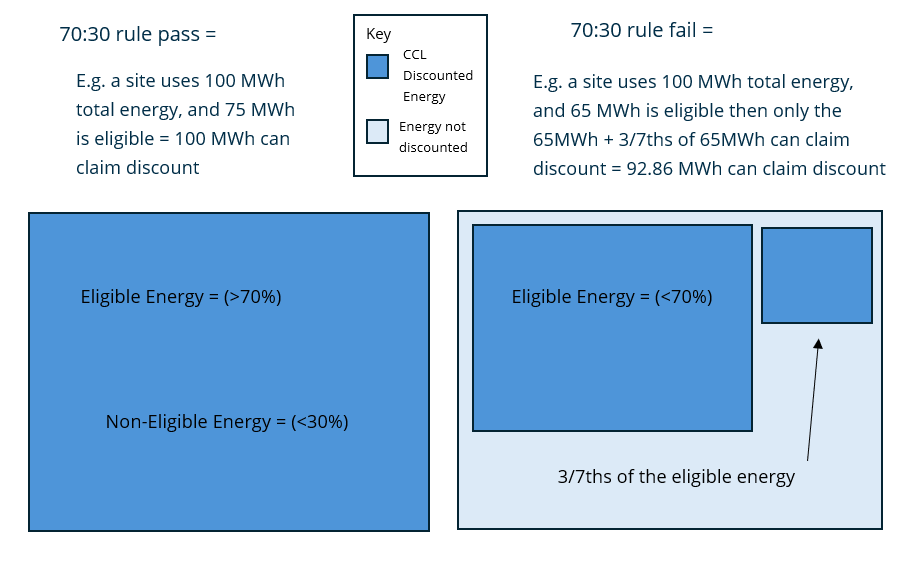

What is the 70:30 rule?

The 70:30 rule means that if more than 70% of all the primary energy used across the whole site is used in the eligible process (dictated by your Trade Association), then 100% of the site can claim the CCL discount.

For example, here are two sites, one passes the 70:30 rule and one does not:

The New 2026 CCA Scheme

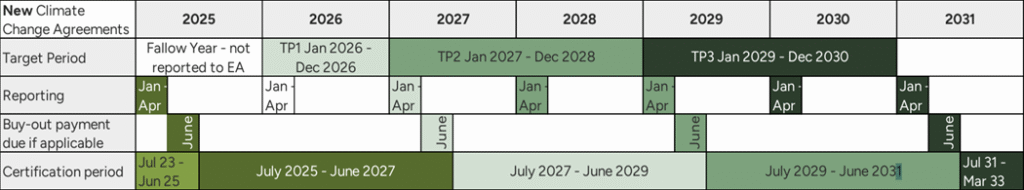

The reporting for the final target period of the current CCA scheme (Jan 2024 – Dec 2024) will be finished by Apr 2025. After this, actions must be taken to participate in the new CCA scheme beginning in 2026.

The new scheme has been confirmed to last 6 years, starting on the 1st of January 2026 (meaning no target for 2025!).

Participants in the current CCA scheme who wish to participate in the new scheme, will be asked to confirm eligibility and will not be automatically migrated over to the new scheme.

Those who do not participate in the current CCA scheme but are in an eligible sector and wish to join, will be able to apply to the scheme between 1st January and 31st August of each year within a Target Period. There will be an initial application window running from 1st May – 31st August 2025 for eligible facilities to apply before the new CCA scheme begins in 2026.

There will be some major changes between the current CCA scheme and the new CCA scheme, including –

- 2022 data as a baseline against which to measure performance (current scheme uses 2018).

- Energy consumption being determined by fixed energy consumption (FEC) and variable energy consumption (VEC).

- Reporting being done at facility-level, eliminating the current ‘bubble’ system wherein multiple facilities can pool together their performance metrics.

- A brief annual report of key actions taken to meet targets or issues that may have impacted on achievement of the target.

Next Steps

Discover the latest key updates to the Climate Change Agreements (CCA) scheme here.

Whether you’re already part of the scheme and need help transitioning to the new rules, or you’re a new entrant looking to get started, Here’s The Plan is here to guide you every step of the way.

Contact us today to learn more and discuss your next steps!

Have Questions? We’re Just a Message Away

What Our Clients Are Saying

Posted onTrustindex verifies that the original source of the review is Google. Lucia is great and very helpful. Highly recommend their services!Posted onTrustindex verifies that the original source of the review is Google. In these testing times i feel very lucky to have Here's The Plan on my side. What a fantastic service they provide when it comes to tendering your energy supplier. This high service continues afterwards by monitoring the suppliers invoicing.Posted onTrustindex verifies that the original source of the review is Google. We have worked with Here's The Plan for close to a decade now and every person we have encountered has been friendly, professional and extremely helpful! Over the years they have saved our community club a small fortune on our utilities and we are so grateful to them for all that they do. We couldn't be happier with them and would highly recommend them to anyone.Posted onTrustindex verifies that the original source of the review is Google. Very attentive + knowledgeable professional team.Posted onTrustindex verifies that the original source of the review is Google. I have found that using Here's The Plan as our companies broker has saved us a lot of time and hassle . They are always there at the end of the phone or email. If there has ever been any problems i would have to say it has always been from the suppliers end and never from H T P . They are professional and deal with any of our problems or questions rapid . Again they just save so us time and hassle so we can get on with our business .Posted onTrustindex verifies that the original source of the review is Google. We have been using Here's The Plan formerly MDG for nearly 20 years for our electricity contracts. I find them extremely efficient and prompt at sorting out any queries I have. Unlike the large electricity companies the phone is answered straight away. I received email quotes every week regarding new contracts and listened to their advice on the market resulting in a good renewal contract. Keep up the good work.Posted onTrustindex verifies that the original source of the review is Google. We have received a five star service from Heres the plan for both our domestic and business electricity supplies. Gordon and Annette have gone above and beyond to ensure we have got the best deal and have held our hand through the whole process of changing suppliers.Posted onTrustindex verifies that the original source of the review is Google. Professional service and a solutions-orientated approach. Would recommend to any organisation looking to achieve energy and cost efficiencies.Posted onTrustindex verifies that the original source of the review is Google. First Class support and professional guidance for our ongoing utilities contract management. Proactive as always by Christina and the full team, helping Star to mitigate against the challenging market conditions.