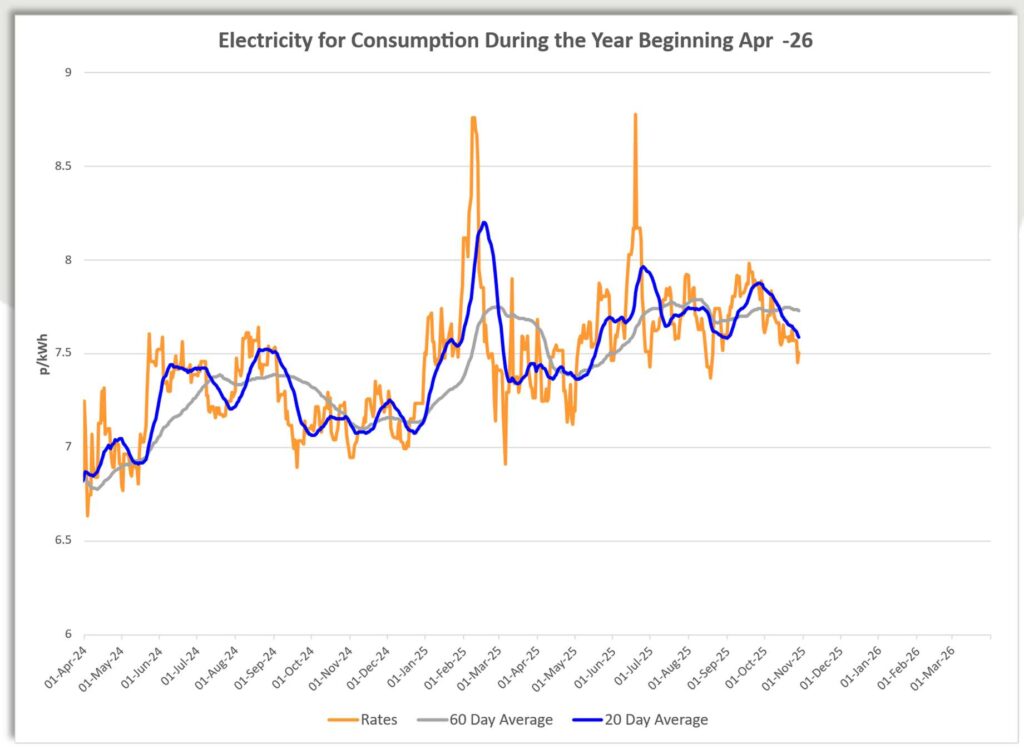

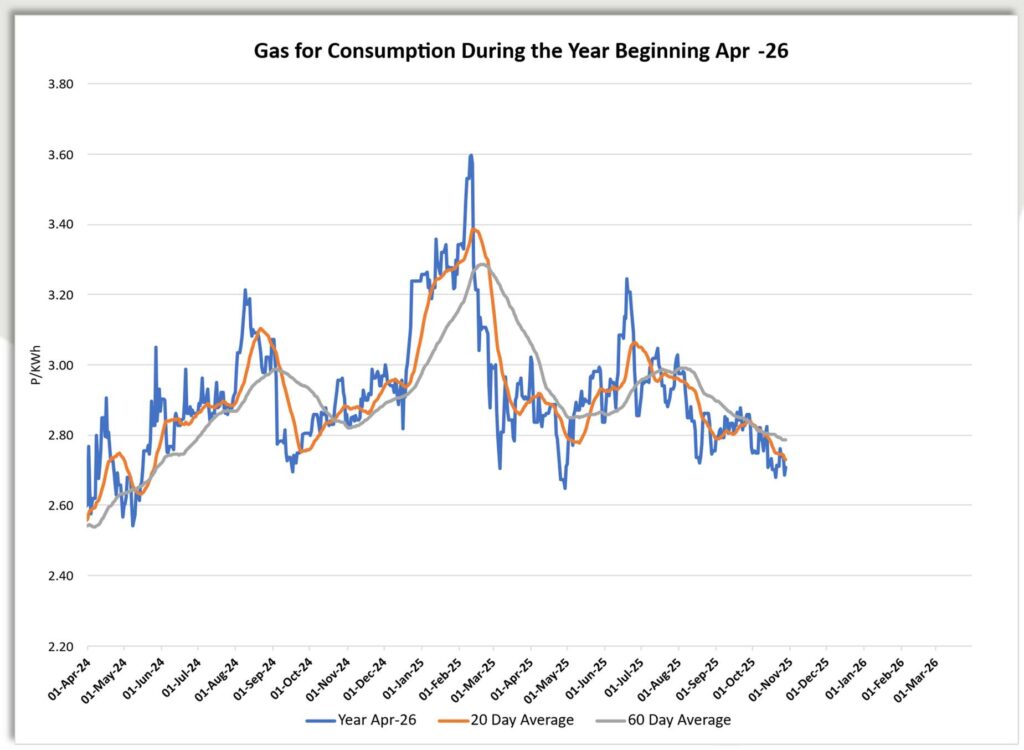

The October 2025 Energy Market update saw energy markets shaped by shifting geopolitics, fluctuating weather, and evolving supply trends, as Europe prepared for winter amid ongoing Russia–Ukraine tensions and global policy changes.

Week of 6th October 2025

Russian strikes severely damaged Ukraine’s gas output, heightening winter supply risks. Europe’s storage outlook weakened, while geopolitical tensions and new EU carbon rules lifted price uncertainty. Analysts advised early fixing for price stability.

Week of 13th October 2025

UK gas supply tightened as domestic output hit record lows, boosting import needs. A ceasefire between Israel and Hamas eased regional risk, but U.S.–China trade tensions revived global volatility. Analysts saw fixing early as prudent for winter.

Week of 20th October 2025

Prices fluctuated as mild weather turned colder and geopolitical risks rose ahead of Trump–Putin talks. EU approved a future Russian gas ban, boosting long-term volatility. Strong renewables and nuclear output helped offset near-term tightness.

Week of 27th October 2025

Milder weather and solid LNG supply softened prices, despite renewed Russian strikes and sanctions. EU plans to ban Russian LNG by 2027 highlighted shifting dependencies. Near-term volatility persisted amid easing demand and stable supply.

Conclusion

Despite near-term price stability, rising geopolitical and policy-driven risks keep markets cautious. Fixing part of future volume now offers security while retaining flexibility for potential mid-term price dips.